Active investors often target "value" companies, those with low market valuations relative to their book values yet demonstrating strong operational performance, as evidenced.

Even if these companies are operationally sound, they are not favorably perceived by the public when compared to their peers. This underscores the importance of benchmarking performance and current strategy against those competitors to determine whether value-generating opportunities are being overlooked.

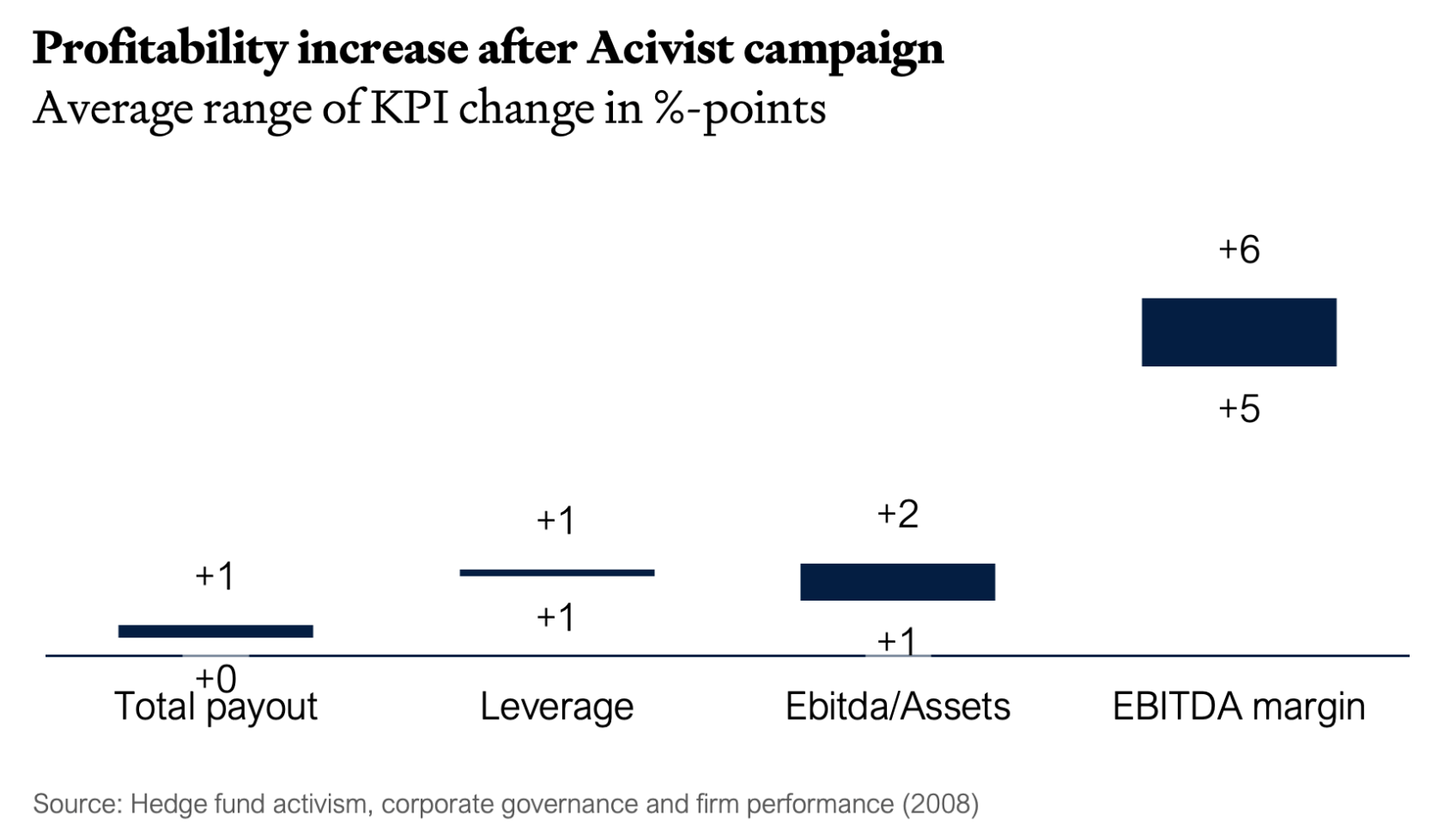

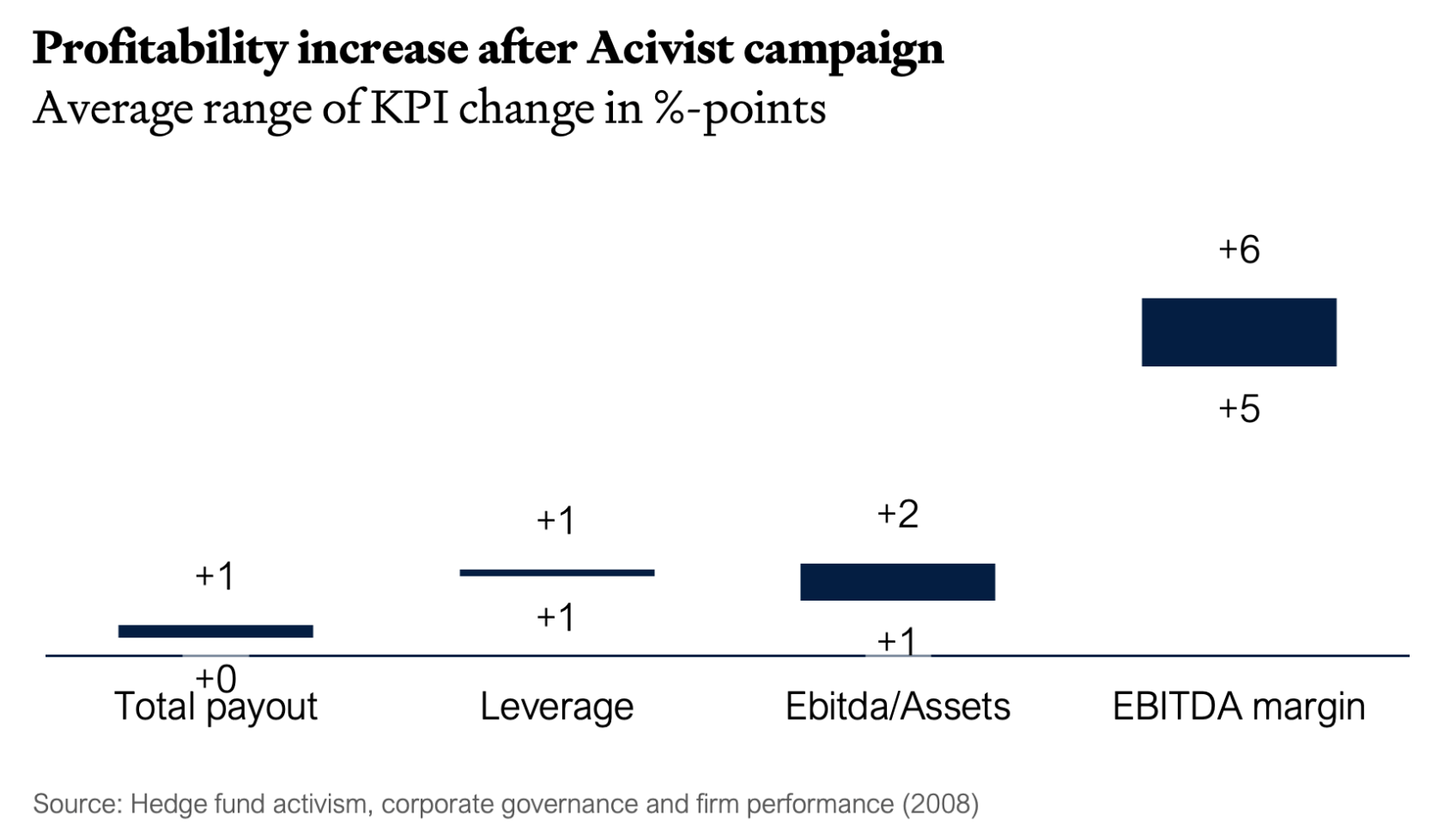

Evidence from activist intervention indicates that targeted firms generally experience a swift improvement in performance. After one year total payout and book value leverage increase, while improvements on Return on Assets and operating margins are registered on the second year from activists engagement (Alon Brav, 2008)

Activism that focuses on alterations in business strategy, such as refocusing and divesting non-core assets, yields the most substantial positive effects. External investors can effectively enhance value when they detect significant allocative inefficiencies. In contrast, while the market does respond positively to capital structure-related activism—including debt restructuring, recapitalization, dividends, and share buybacks—the impact is not statistically significant.

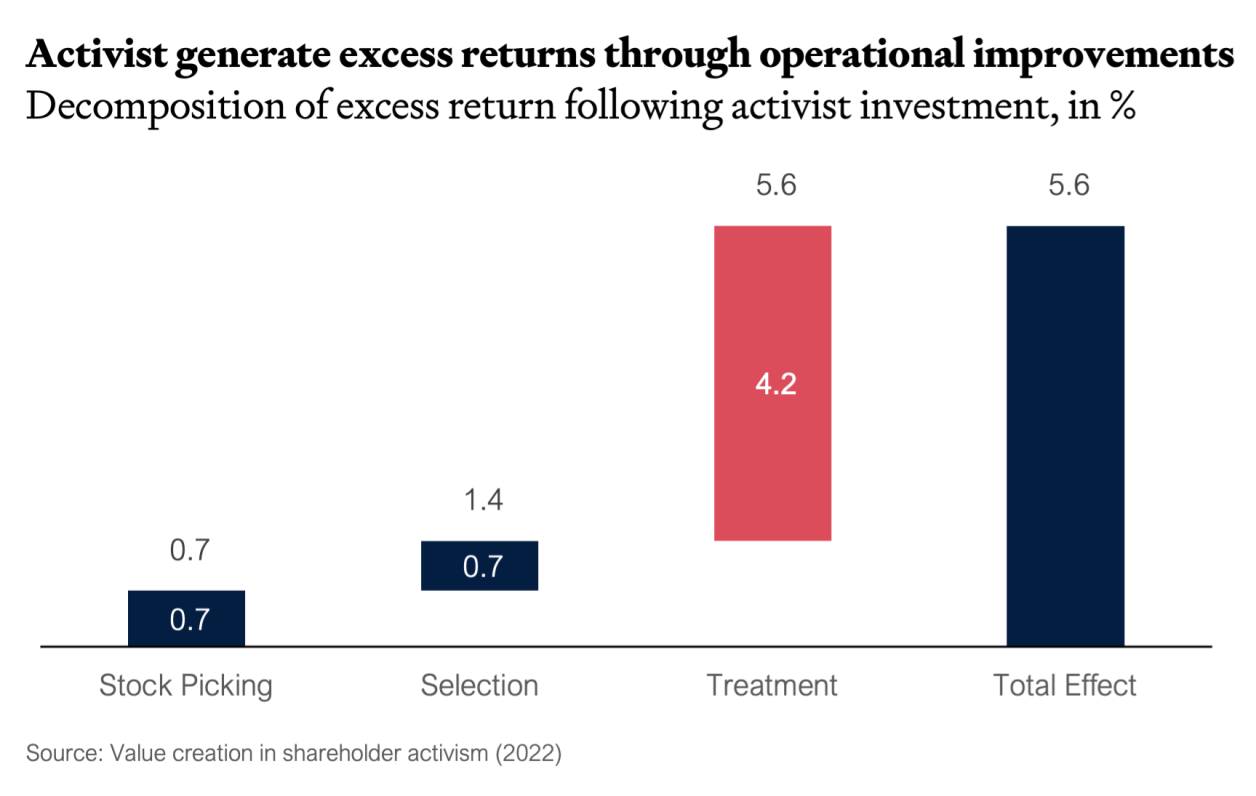

Given value is created through strategic measures, the ex-ante due diligence is where the foundation is laid. Due diligence is a critical process for identifying value-generating opportunities. From a theoretical standpoint, transparent disclosure of private information is estimated to double the number of companies targeted by active shareholders, as a clear understanding of the business’s financials and operational data allows investors to identify potential value-generating opportunities, with expected returns estimated to increase by 0.7 percentage points (Rui Albuquerque, 2022).

However, activism comes at a cost, and actions targeting specific companies are undertaken only when expected returns outweigh these costs. Research indicates that 62% of passive investment positions would generate better returns if an activist approach were employed. The mean excess return attributed to activism is estimated at 5.6% consisting of 75% expected value creation (“treatment”), 13% attributable to stock picking, and 12% resulting from sample selection bias effects (Rui Albuquerque, 2022). From a shareholder perspective, this compelling evidence of untapped value underscores the potential for companies to enhance their performance through a consistent investment in understanding their strategic focus.

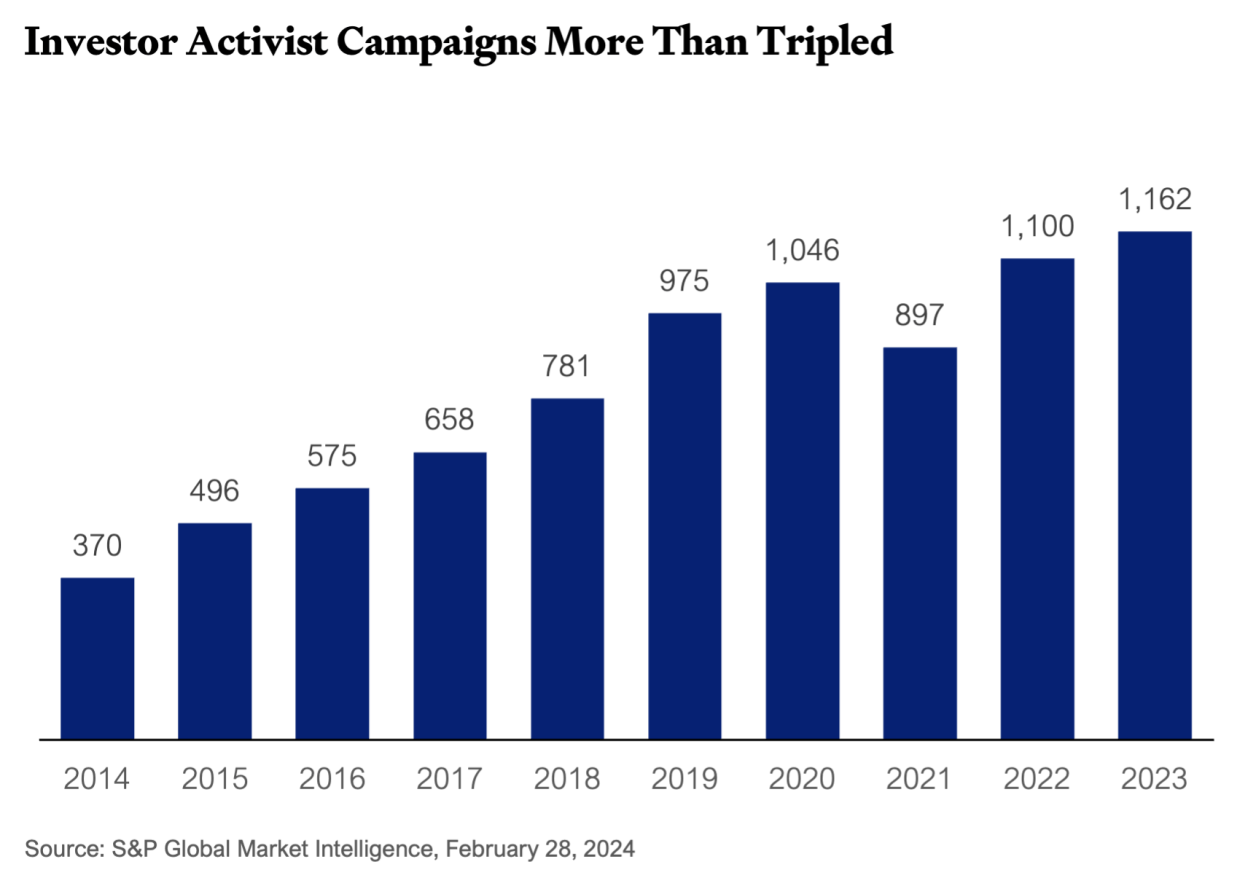

Investor activism reached a record high in 2023, with 1,162 campaigns reported, a rise from 1,100 in 2022 and significantly up from 370 in 2014. These campaigns, which include shareholder proposals and proxy fights, are driven by demands for changes in executive pay, climate initiatives, and racial justice. Companies are pushing back through lawsuits to block proposals and limit regulatory oversight. Despite this resistance, many activist proposals are expected to be adopted, and activism is projected to continue increasing as shareholders seek more influence. With a strong record of success and potential economic changes, activism is unlikely to slow down in the coming years. In response to rising activism, corporations are increasingly challenging these campaigns legally (Scheid, 2024).

While they generate value for shareholders, it is essential to note that 30% of activist interventions are hostile to management and can result in proxy contests, takeover lawsuits, or public campaigns that are openly confrontational. Therefore, it is prudent for companies to take precautionary measures to mitigate external threats (Rui Albuquerque, 2022).

Companies can proactively anticipate potential external threats from active shareholders by regularly assessing whether their strategy requires updating, ensuring alignment with operational activities, and evaluating performance against both new and existing peers. These proactive measures have been shown to generate value at minimal costs compared to the benefits realized.

Flipping the logic around, both private and public companies can -and should- take activist investors’ approach as cue that there is value to be generated by conducted a rigorous strategy review followed by targeted execution.

Moreover, the costs associated with identifying and managing value-generating activities decrease when experienced professionals are involved. Estimates indicate that these costs decline from 4.6% of the ex-post value of the filer’s stake to 2.4%, with investor experience serving as the primary driver. Intuitively, experienced professionals are better equipped to identify inefficiencies and implement effective value-generating solutions (Rui Albuquerque, 2022).

Associate

Managing Partner

Alon Brav, W. J. (2008). Hedge Fund Activism, Corporate Governance,. The Journal Of Finance, 47.

Rui Albuquerque, V. F. (2022). Value Creation in Shareholder Activism. Journal of Financial Economics, 26.

Scheid, B. (2024, March 6th). Investor activism surges as companies react to proposed changes. Market Intelligence, p. 2.

Free AI Website Builder